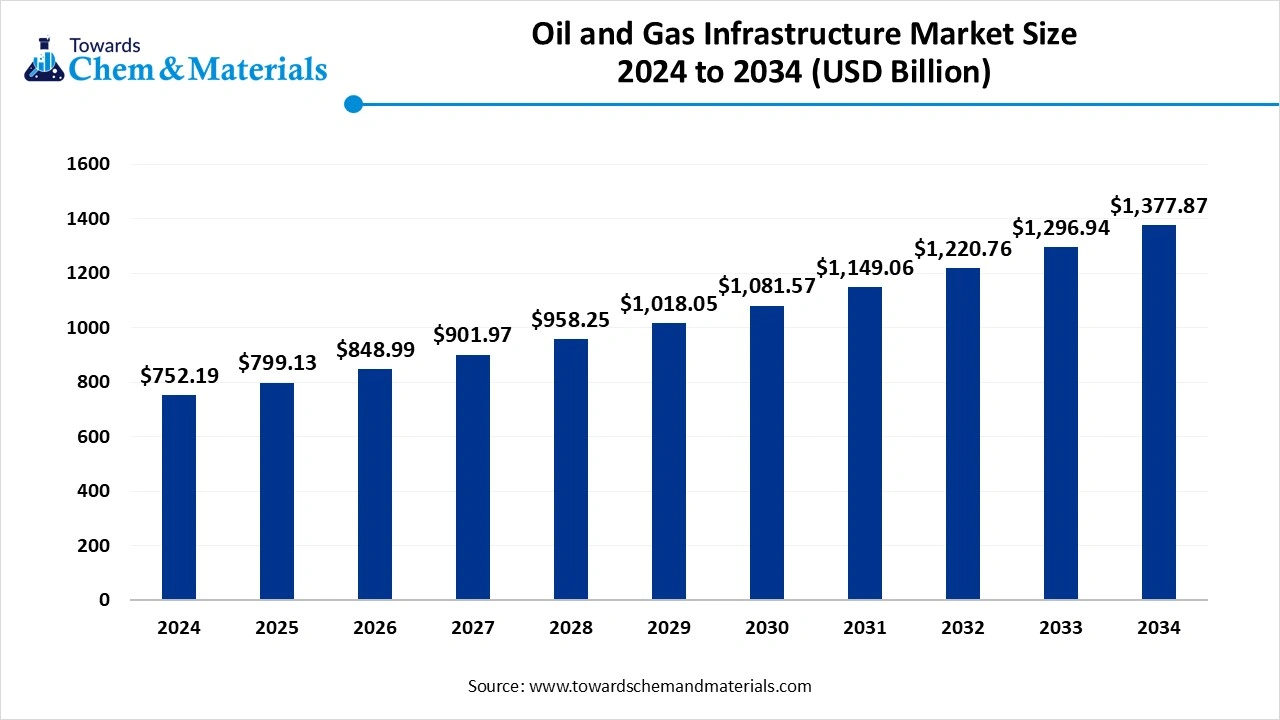

Oil & Gas Infrastructure Market Size to Reach USD 1,377.87 Billion By 2034

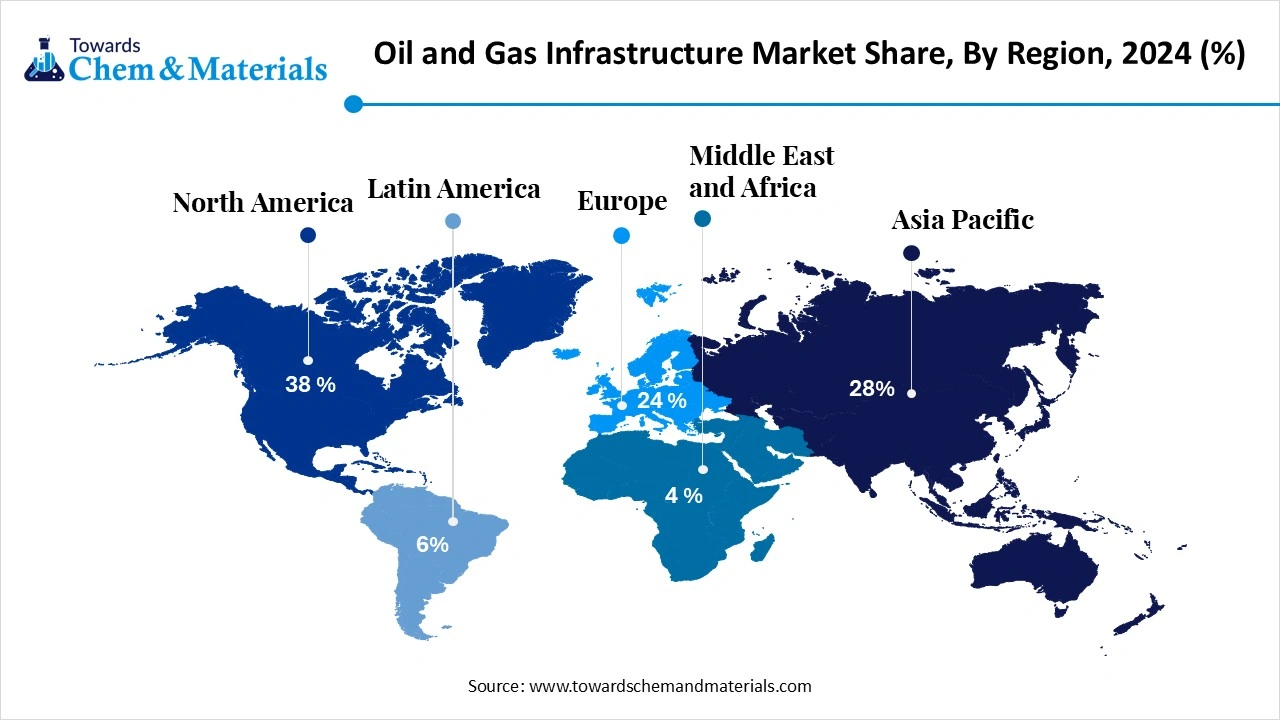

According to Towards Chemical and Materials, the global oil & gas infrastructure market size was estimated at USD 752.19 billion in 2024 and is projected to reach USD 1,377.87 billion by 2033, growing at a CAGR of 6.24% from 2025 to 2034. North America dominated the oil & gas infrastructure market with a market share of 38% in 2024.

Ottawa, Aug. 08, 2025 (GLOBE NEWSWIRE) -- The global oil & gas infrastructure market size is valued at USD 799.13 billion in 2025 and is expected to hit around USD 1,377.87billion by 2034, growing at a compound annual growth rate (CAGR) of 6.24% over the forecast period from 2025 to 2034. A study published by Towards Chemical and Materials a sister firm of Precedence Research.

Discover Growth Opportunities in Oil & Gas Infrastructure – Get Your Sample Report Now! https://www.towardschemandmaterials.com/download-sample/5743

Oil & Gas Infrastructure Market Overview

The market is growing rapidly, as demand for energy increases, geopolitical factors require energy-demand security, and extensive spending occurs on pipelines, LNG terminals, and offshore facilities.

Oil and gas infrastructure includes the physical components of industries’ intermediary assets that extract, transport, store, and distribute hydrocarbons, including pipelines, storage tanks, terminals, processing plants, and refineries. The changing landscape of the oil & gas infrastructure market is driven by increases in global energy consumption, sustained investments into LNG infrastructure and upgrades to aging assets.

In addition to international tensions and expanding energy security protocols, countries are expanding and diversifying the energy infrastructure in an effort to secure energy supply. While newer projects revolve around the traditional oil and gas supply, we are starting to see more integration of digital technologies and a pivot to decarbonization projects with the oil and gas sector. Other than sustaining supply from fossil fuels, this market represents an opportunity for transitioning fossil fuel driven energy systems to cleaner energy systems.

What are the business benefits of oil and gas infrastructure Market?

As oil and gas companies modernize operations, many turn to digital technologies and services to optimize processes while maintaining existing infrastructure—from pipeline inspections to refinery optimization. Because energy companies use complex assets in the field and in plants that require ongoing maintenance, asset management solutions are key to proper infrastructure maintenance. So too are systems that schedule human and material resources for repairs, manage inventory, and provide mobile solutions for field employees to access data and submit reports.

Increasingly, business rests on the readiness of a company’s IT infrastructure to adapt to changing business conditions. Aging, sluggish or inefficient IT infrastructure poses as big a threat as any disruptive market force.

Stay Ahead with Detailed Analysis – Get the Full Report! https://www.towardschemandmaterials.com/price/5743

Oil & Gas Infrastructure Market Report Scope

| Report Attribute | Details |

| Market Size value in 2025 | 799.13 USD Billion |

| Revenue Forecast in 2034 | 1,377.87 USD Billion |

| Growth rate | CAGR of 6.24% from 2025 to 2034 |

| Actual data | 2021 - 2024 |

| Forecast period | 2025 - 2034 |

| Segments covered | By Sector, By Infrastructure Type, By Material Type (For Pipeline & Facility Construction),By Fuel Type, By Ownership/Operator,By End-Use Application, By Region |

| Key companies profiled | Kinder Morgan Inc., Enbridge Inc. , TransCanada Corporation (TC Energy), Saudi Aramco , Gazprom , Shell Plc , ExxonMobil Corporation , Chevron Corporation , TotalEnergies SE , BP Plc , Cheniere Energy Inc. , Fluor Corporation , Bechtel Corporation , Technip Energies , Petrofac Ltd.. |

For more information, visit the Towards Chemical and Materials website or email the team at sales@towardschemandmaterials.com| +1 804 441 9344

Oil & Gas Infrastructure Market Trends?

- Growth in LNG Infrastructure- The increased demand for cleaner-burning fuels has led to heavy investment into liquefied natural gas terminals, storage, and shipping capacity largely in the Asia-Pacific and European regions.

- Digitalization and Smart Infrastructure- Operators continue to leverage IoT, AI, and automation to improve access and enhance monitoring of pipelines, minimize downtime, and optimize operational efficiency across refineries and processing facilities.

- Renewing Aging Infrastructure- Many existing pipelines and refineries are being retrofitted or replaced to achieve the current safety, environmental, and efficiency standards, particularly in North America and Europe.

- Transitioning to Low-Carbon Infrastructure- The goals of energy transition have compelled companies to install carbon capture systems, while some companies are also working to revive and repurpose their existing infrastructure to support the storage and transportation of hydrogen and biofuels.

AI Supercharges Oil & Gas Infrastructure, From Digital Twins to Predictive Operations

Through smarter modeling, predictive maintenance, and agility of operations, artificial intelligence is driving the transformation of oil and gas infrastructure. In August 2025, KBC launched Petro- SIM® v7.6, a digital twin platform that integrated artificial intelligence and machine learning, excitingly applied to real-time process simulation, allowing engineers to simultaneously optimize upstream and downstream decision-making with higher fidelity and decarbonization management.

Saudi Aramco is exploring implementing AI tools such as DeepSeek and its own TeraPOWERS system to reprocess decades of existing seismic data, converting historical datasets into actionable intelligence for drilling, reservoir modeling, and emissions reduction.

In September 2024, BP and Palantir Technologies introduced new artificial intelligence capabilities with Palantir’s AIP software in collaboration with Palantir, increasing safety, predictive maintenance, incorporating better and safer decision-making for its critical assets.

Together, these unique projects demonstrate how AI initializes with a narrow pilot use phase and transitions to embedded intelligence for infrastructure, resulting in increased resilience, lower costs, and lower carbon footprints for oil and gas value chains.

Oil & Gas Infrastructure Market Dynamics

Market Drivers

Rising Global Natural Gas Demand Driving Oil & Gas Infrastructure Growth

One of the main arrows in the oil & gas infrastructure market quiver, is also rising global natural gas demand rapidly increasing throughout the world, especially for power generation and industrial consumption. The International Energy Agency stated worldwide gas demand grew by 2.7% in 2024 - 115 billion cubic meters,

The strongest growth for all fossil fuels, as gas generation started to increase utilization worldwide in power generation during weather events. Infrastructure is being built at this demand level.

In August 2025, Energy Transfer has recently begun construction on a 516-mile, 42-inch Transwestern Pipeline expansion project, which is anticipated to deliver 1.5 billion cubic feet of gas per day.

These developments bring to light the role of the infrastructures' underlying transport and compressions systems that will support the increasing levels of demand for energy and powers associated with increasing electrification and diversify in industries.

Market Opportunity

Is the Surge in Global Energy Investments Opening Profitable Opportunities for Oil and Gas Infrastructure Developers?

From a business outlook, we can see that a substantial influx of capital into oil and gas infrastructure projects is taking place in a global environment driven by energy security concerns and the need for procurement diversification. Global upstream oil and gas investment for 2024 increased by 7% to reach $570 billion, following a 9% rise in 2023, and there will be a major amount spent on infrastructure, consisting of pipelines, long terminals and storage terminals.

Major players are expanding their export and processing capacity to meet the demands arising and anticipated from Europe, Asia and Africa. The increase in cross-border energy trade, and formation of regional partnerships like the new hubs in Africa, and pipeline expansion in Central Asia, are creating a long-term pathway for commercial opportunities for infrastructure developers, EPC contractors, and investors targeting resilient energy assets during an international transition period.

Market Challenges

- Highly Capital Intensive- The initial investment required to build infrastructure is very high (for example, pipelines, refineries, and storage). These relatively large capital commitments have associated risks. When oil prices are volatile (low) and long-term demand is uncertain, the financial investment is even riskier.

- Increased Regulatory and Environmental Pressure- Numerous environmental regulations and permit delays add complexity and expense to ambitious projects. Growing concern related to climate change and emissions reduction is increasing the unease to phase out fossil-fuel infrastructure in favour of greener alternatives.

- Political Instability- Political unrest, trade barriers, and conflict in regions rich with oil disrupt infrastructure development and integration in regional/ cross borders. Managing uncertainty complicates planning, increases expense, and likewise increases the risk of project investments for the long-term.

- Aging Infrastructure- In most developed countries, aging oil and gas related infrastructure is predominant. It is expensive to maintain and upgrade, as a greater tendency increases unplanned outages, personnel, leaks, accidents, and operational inefficiencies, and decrease overall reliability.

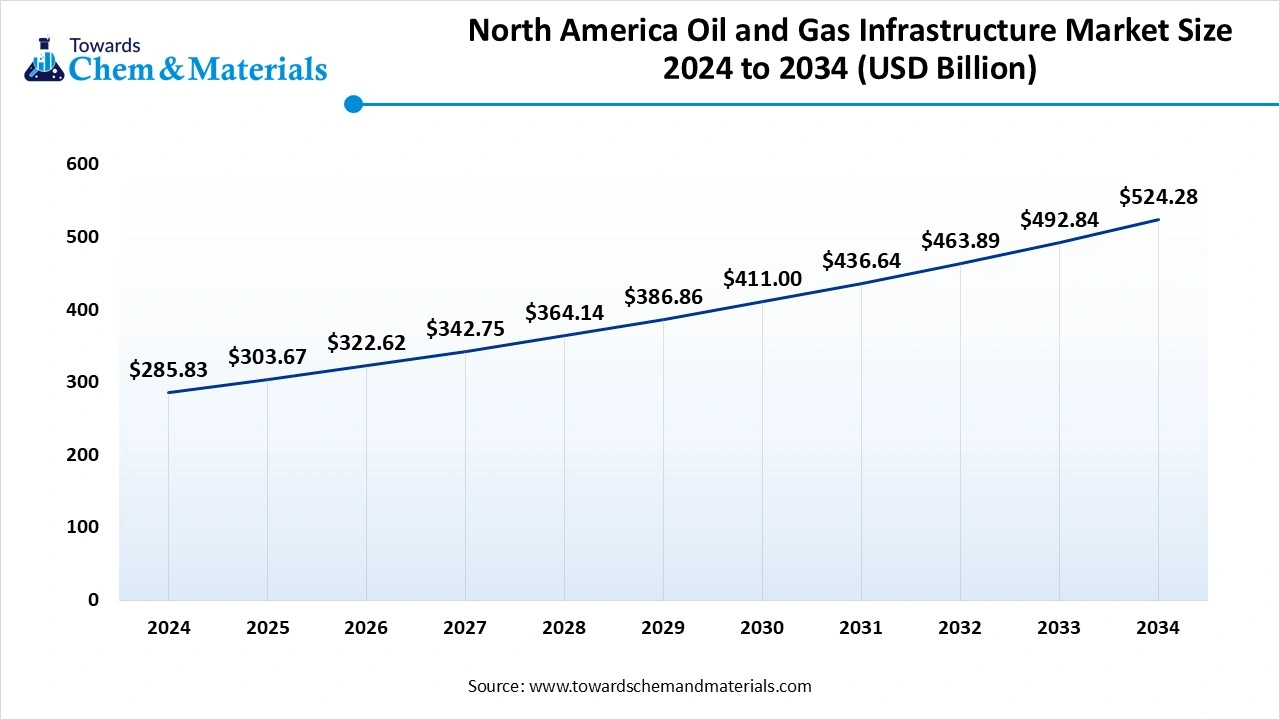

North America Market Size and Forecast 2025 to 2034

The North America Oil and Gas Infrastructure market size is estimated at USD 303.67 billion in 2025 and is anticipated to USD 524.28 billion by 2034, growing at a CAGR of 6.25% from 2025 to 2034.

North America dominated the market in 2024, it is the leading region in the world for oil and gas infrastructure, primarily due to its developed and integrated pipeline systems, export terminals and storage. The North American region features a stable and private supported investment which ensures older infrastructure is refurbished while still growing new capacity primarily around liquid natural gas (LNG) and midstream transport. Continued coordination between production, logistical capacity and innovation ensures that North America is a core global hub for oil and gas.

U.S. Market Trends

The United States is central to the existing North American dominance through its production capacity and export strategies and midstream networks. Infrastructure growth is not only an energy objective, but also a driver of economic activity with initial estimates of investments in oil and gas infrastructure estimated to bring just over $1.5 trillion to $1.89 trillion of contributions to U.S. Gross Domestic Product (GDP), or roughly $79 to $100 billion every year annually throughout the projection period.

This implies the importance of the oil and gas sector to energizing energy independence and economic development, and with continued federal and private sector support, the U.S. can remain a global benchmark for oil and gas infrastructure development.

Why Is Asia Pacific The Fastest Growing Region In The Oil & Gas Infrastructure Market?

Asia Pacific expects the fastest growth in the market during the forecast period. Asia Pacific is experiencing explosive growth due to soaring energy demand, ongoing industrialisation, and the shift toward cleaner fuels like natural gas. Governments in Asia Pacific are developing LNG terminals, cross-border pipelines, and energy storage infrastructure to support long-term energy security. The proactive stance is taken by government policies across numerous countries, including India and China, to build out midstream infrastructure. Means that population growth and the demand for increasingly cheaper energy consumption will make this region the most vibrant and fastest-growing region of the global oil & gas infrastructure market.

India Market Trends

India is the leader of the infrastructure expansion that is taking place in Asia, as its energy needs continue to grow, bolstered by effective government policy and support. India’s oil demand is projected to double to 11 million b/d by 2045, requiring significant upgrades to transport and storage systems. For example, the FY26 Union Budget allocated ₹5,597 crore (US$640 million) for expanding strategic petroleum reserves.

In response to these compelling indicators, India is moving decisively to pursue energy security by building out LNG terminal capacity, a national gas grid and developing underground storage capacity for crude.

More Insights in Towards Chemical and Materials:

- Oil & Gas Market : The global Oil & Gas-market size was valued at USD 6.10 Trillion in 2024, grew to USD 6.33 Trillion in 2025, and is expected to hit around USD 8.79 Trillion by 2034, growing at a compound annual growth rate (CAGR) of 3.72% over the forecast period from 2025 to 2034.

- AdBlue Oil Market : The global adblue oil market size was accounted for 76.58 billion liters in 2024 and is expected to be worth around USD 148.37 billion liters by 2034, growing at a compound annual growth rate (CAGR) of 6.84% during the forecast period 2025 to 2034.

- Natural Gas Market : The global natural gas market size accounted for USD 4.19 trillion in 2024 and is predicted to increase from USD 4.41 trillion in 2025 to approximately USD 6.96 trillion by 2034, expanding at a CAGR of 5.20% from 2025 to 2034.

- Oil Spill Management Market : The global oil spill management market size was reached at USD 151.71 billion in 2024 and is estimated to surpass around USD 210.92 billion by 2034, growing at a compound annual growth rate (CAGR) of 3.35% during the forecast period 2025 to 2034.

- Renewable Natural Gas Market : The global renewable natural gas market size is calculated at USD 15.5 billion in 2025 and is forecasted to reach around USD 31.37 billion by 2034, accelerating at a CAGR of 8.15% from 2025 to 2034.

- Asia Pacific Oil & Gas Infrastructure Market : The Asia Pacific oil & gas infrastructure market size accounted for USD 207.77 billion in 2025 and is forecasted to hit around USD 365.90 billion by 2034, representing a CAGR of 6.49% from 2025 to 2034.

- Gas Separation Membrane Market : The global gas separation membrane market was valued at approximately USD 1.85 billion in 2024 and is projected to grow at a CAGR of 6.95% from 2025 to 2034, reaching a value of USD 3.62 billion by 2034.

- Boiler Market : The global boiler market size was reached at USD 100.29 billion in 2024 and is expected to be worth around USD 199.32 billion by 2034, growing at a compound annual growth rate (CAGR) of 7.11% over the forecast period 2025 to 2034.

- Boiler Water Treatment Chemicals Market : The global boiler water treatment chemicals market size was reached at USD 5.52 billion in 2024 and is expected to be worth around USD 15.46 billion by 2034, growing at a compound annual growth rate (CAGR) of 10.85% over the forecast period 2025 to 2034.

- Industrial Boiler Market : The global industrial boiler market size was reached at USD 17.11 billion in 2024 and is expected to be worth around USD 24.96 billion by 2034, growing at a compound annual growth rate (CAGR) of 3.85% over the forecast period 2025 to 2034.

- Hot Rolled Coil (HRC) Steel Market : The global hot rolled coil (HRC) steel market size accounted for USD 355.42 billion in 2024, grew to USD 375.86 billion in 2025, and is expected to be worth around USD 621.65 billion by 2034, poised to grow at a CAGR of 5.75% between 2025 and 2034.

- Hydrogenated Vegetable Oil Market : The global hydrogenated vegetable oil market size accounted for USD 35.25 billion in 2024 and is predicted to increase from USD 37.84 billion in 2025 to approximately USD 71.64 billion by 2034, expanding at a CAGR of 7.35% from 2025 to 2034.

- Reusable Oil Absorbents Market ; The global reusable oil absorbents market size was valued at USD 412.75 million in 2024. The market is projected to grow from USD 434.42 million in 2025 to USD 688.51 million by 2034, exhibiting a CAGR of 5.25% during the forecast period.

- U.S. Oil & Gas Infrastructure Market : The U.S. oil & gas infrastructure market size was reached at USD 78.85 Billion in 2024 and is expected to be worth around USD 147.32 billion by 2034, growing at a compound annual growth rate (CAGR) of 6.45% over the forecast period 2025 to 2034.

- Europe Oil & Gas Infrastructure Market : The global Europe oil & gas infrastructure market size was reached at USD 85.11 billion in 2024 and is expected to be worth around USD 140.09 billion by 2034, growing at a compound annual growth rate (CAGR) of 5.11% over the forecast period 2025 to 2034.

- U.S. Oil & Gas Market : The U.S. oil & gas market volume is calculated at USD 1.55 trillion in 2024, grew to USD 1.61 trillion in 2025, and is projected to reach around USD 2.24 trillion by 2034. The market is expanding at a CAGR of 3.75% between 2025 and 2034.

Oil & Gas Infrastructure Market Top Key Companies:

- Kinder Morgan Inc.

- Enbridge Inc.

- TransCanada Corporation (TC Energy)

- Saudi Aramco

- Gazprom

- Shell Plc

- ExxonMobil Corporation

- Chevron Corporation

- TotalEnergies SE

- BP Plc

- Cheniere Energy Inc.

- Fluor Corporation

- Bechtel Corporation

- Technip Energies

- Petrofac Ltd.

Recent Developments

- In March 2025, Morocco intends to launch a $6 billion tender to plan and develop natural gas infrastructure including but not limited to LNG import terminals, increased distribution pipelines, and support for local production to help Morocco achieve its goal to reach 52% renewable energy by 2030.

- In June 2025, CENAGAS, Mexico's gas system operator, launched public consultations to evaluate the demand for natural gas and to develop future five year plans related to infrastructure expansion, whilst aiming to improve transport and storage across the country.

-

In October 2024, Enbridge has finalized the acquisition of the Public Service Company of North Carolina (PSNC) from Dominion Energy. This is intended to increase Enbridge’s U.S. natural gas infrastructure across several high growth states.

Oil & Gas Infrastructure Market Report Segmentation

This report forecasts revenue growth at global, regional, and country levels and provides an analysis of the latest industry trends in each of the sub-segments from 2019 to 2034. For this study, Towards Chemical and Materials has segmented the global Oil & Gas Infrastructure Market

By Sector

- Upstream (Exploration & Production)

- Midstream (Transportation & Storage)

- Downstream (Refining & Distribution)

By Infrastructure Type

- Pipelines (Oil, Gas, Multiphase)

- Offshore & Onshore Platforms

- Liquefaction & Regasification Terminals (LNG)

- Storage Tanks & Caverns

- Compressor & Pumping Stations

- Refineries

- Petrochemical Plants

- Gas Processing Units (Dehydration, Sweetening)

- Distribution Networks (Retail Outlets, Gas Stations)

By Material Type (For Pipeline & Facility Construction)

- Steel (Carbon Steel, Stainless Steel)

- Concrete

- Polyethylene & Other Thermoplastics

- Composite Materials

By Fuel Type

- Crude Oil

- Natural Gas

- Liquefied Natural Gas (LNG)

- Refined Products (Gasoline, Diesel, Jet Fuel)

- Liquefied Petroleum Gas (LPG)

By Ownership/Operator

- National Oil Companies (NOCs)

- International Oil Companies (IOCs)

- Pipeline Transportation Companies

- Independent Terminal Operators

- Engineering, Procurement & Construction (EPC) Firms

By End-Use Application

- Power Generation

- Industrial Use (Chemicals, Fertilizers, Cement)

- Residential & Commercial Use

- Transportation (Aviation, Marine, Road Fuel)

By Regional

- North America

- Europe

- Asia Pacific

- Latin America

- Middle East Africa

Immediate Delivery Available | Buy This Premium Research Report@ https://www.towardschemandmaterials.com/price/5743

About Us

Towards Chemical and Materials is a leading global consulting firm specializing in providing comprehensive and strategic research solutions across the chemical and materials industries. With a highly skilled and experienced consultant team, we offer a wide range of services designed to empower businesses with valuable insights and actionable recommendations.

Our Trusted Data Partners

Precedence Research | Statifacts | Towards Packaging | Towards Healthcare | Towards Food and Beverages | Towards Chemical and Materials | Towards Consumer Goods | Nova One Advisor |

USA: +1 804 441 9344

APAC: +61 485 981 310 or +91 87933 22019

Europe: +44 7383 092 044

Email: sales@towardschemandmaterials.com

Web: https://www.towardschemandmaterials.com/

Legal Disclaimer:

EIN Presswire provides this news content "as is" without warranty of any kind. We do not accept any responsibility or liability for the accuracy, content, images, videos, licenses, completeness, legality, or reliability of the information contained in this article. If you have any complaints or copyright issues related to this article, kindly contact the author above.